Moulding a new era of banking.

We’re crafting a new-age banking experience that is inclusive, technology-driven and more accessible than ever before. Unity is a collaboration between Centrum Financial Services (The Centrum Group) and Resilient Innovations (BharatPe).

Our aim is to

simplify banking

Our vision

To make banking available at our customers' fingertips using the latest technology.

Our mission

We shall empower everyone to build for their future, combining technology with inclusivity to bring progress and simplicity in banking.

Significant milestones on this journey

₹ 11,000 Cr+

Deposits

₹ 8,500 Cr+

Advances

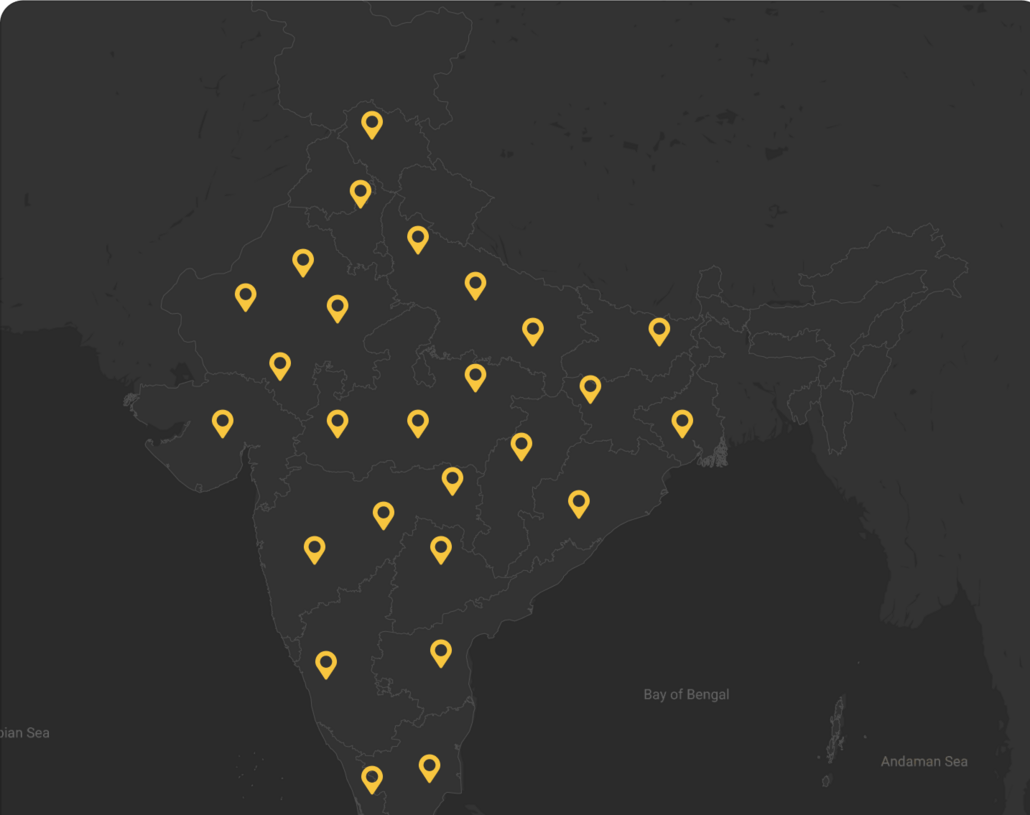

~334

Locations Pan India

Defined by our values,

driven by innovation

Ownership:

Get it DONE now.

We are opportunity seekers and creators, and we’ll go above and beyond to help customers seize their financial potential.

Customer First:

Deliver WOW.

We strive to offer best-in-class services and thoughtfully curated financial products that are attuned to our customer’s needs and comforts.

Co-Creation:

Find new ways TOGETHER

We value collaboration, cooperation and harmony. Our customers are our partners on this journey, and through mutual respect and trust, we’ve built lasting, valuable relationships.

Integrity:

Do the RIGHT thing.

With our arsenal of transparent, empowering practices that are driven by technology, we serve our customers with honesty and diligence.

Meet the team that brings

Unity to life

Unity's success is driven by a dedicated team of over 5,000 employees across more than 400 locations, guided by the expertise and wisdom of our astute leadership.

Serving customers

across the nation

From coast to coast, across towns, cities and rural areas, our nationwide network makes banking truly accessible.