CREDIT CARDS

Welcome to a world of new age features and rewards

From shopping to dining to emergency needs — Credit Card programs by Unity offer unparalleled convenience, rewards, and flexibility. Our digital-first and innovative features are designed exclusively for you.

Smarter Spending, Smarter Choices

Why Choose a Credit Card

from Unity Bank?

Lifetime Free Card

No Joining Fees. No Annual Fees. Our cards are Lifetime Free for you.

Make UPI payments on Credit Card

No wallet. No fuss. Just seamless UPI compatibility.

Unmatched Cashback & Rewards

Up to 20% cashback on chosen categories for select cards or uncapped rewards on EMIs! Let your spends earn!

Innovation Reimagined

Manage big ticket spends with easy and rewarding EMI options or all your payments under one roof, we have you covered with our innovative card offerings.

Powerful Digital Features

100% digital onboarding, card controls, intuitive spend analytics and much more!

Why Choose a Credit Card

from Unity Bank?

UPI Payments on

Credit Card

Make UPI payments directly using your credit card

no wallet, no fuss.

Lifetime Free Options

Enjoy zero joining and renewal fees

Attractive Cashback

Enjoy higher rewards on EMIs and chosen spend categories, through our credit card programs.

Innovative Options

Plan big-ticket purchases and easy EMI options or get a card for everyday use, our uniquely designed credit cards have you covered for every need.

Smart Digital Features

Analyse your spends, manage card controls, download your statement and much more.All via the app.

Choose your card

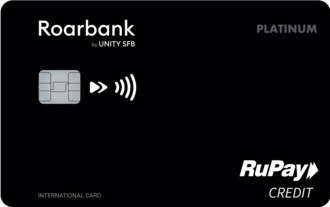

Roarbank Credit Card

India’s first 2-in-1 Credit Card that combines a digital savings account, so you stay in total control of your finances.

- Manage all payments through one powerful mobile application

- Interest-free credit period of up to 62 days*

- Up to 20% cashback on your top 2 chosen categories every month

- Bundled savings account allows you to transact more and earn attractive interest rate

- Shake-to-pay feature for the newest way of instant peer transfers

Benefits of Using a Credit Card Wisely

Using your credit card the right way isn’t just about convenience it can actively improve your financial profile. Here's how:

Build Your Credit Score:

Timely repayments are reported to credit bureaus and can improve your CIBIL score, making it easier to qualify for loans in the future.

Earn Rewards and Cashback:

Most cards offer attractive cashback offers on different spend categories such as groceries, fuel, or fashion. Over a year, that could add up to significant savings.

Emergency Credit Access

Whether it’s a sudden hospital bill or last-minute travel, having a card with a decent limit can save you from borrowing at high interest elsewhere.

Exclusive Privileges:

Cards often come with lounge access, concierge services, travel insurance, movie ticket offers, etc., which you might never access otherwise.

Ease of Foreign Transactions:

Most credit cards are internationally accepted, making them essential for travel and online shopping from global platforms.